Money can feel complicated, not because it truly is, but because it is often explained poorly. Many finance platforms assume prior knowledge and use language that distances ordinary readers. Money disquantified org approaches financial learning from a different angle by focusing on clarity, everyday relevance, and steady understanding.

The site targets people who want to get into a more satisfactory relationship with money and do not have to get overwhelmed with technical terminology. It suggests learning at a slow pace and the explanations are real-life based, and practicable. Such approach will eventually cause the readers to become less anxious and more certain about making financial decisions.

What Is Money Disquantified Org?

Money Disquantified Org is an educational website designed to explain personal finance concepts in a simple and relatable way. Its purpose is to help readers understand money without the fear that usually comes with financial topics. Instead of pushing aggressive wealth-building ideas, the platform promotes realistic thinking and long-term habits.

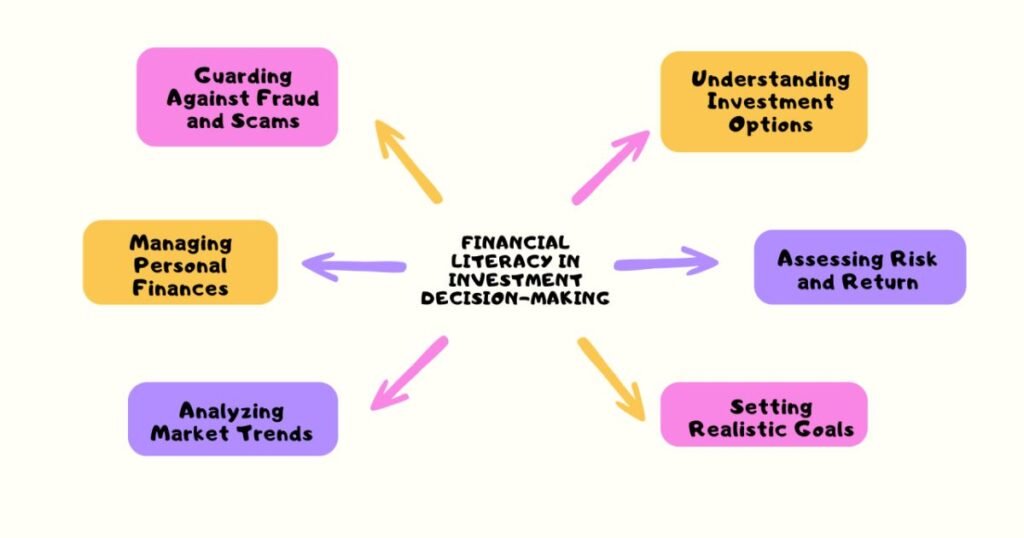

Some of the topics discussed on the site include budgeting, saving, basic investment knowledge, and financial mindset. The topics are all written in a way that is simple and easy-to-understand way for beginners so that the explanations seem to be natural. The structure enables the reader to develop the basic knowledge, then move to the more developed sources in other fields.

Who Should Read Money Disquantified Org?

The platform is best suited for beginners and casual learners who want to understand money in a relaxed and approachable way. It is particularly useful among students, young professionals, and those who were not taught financial education formally. A great number of readers visit the site as they want to change their money patterns without feeling disrespected and pressured.

Advanced investors or professionals may find the content too basic, as the site does not focus on deep market analysis or technical strategies. However, this simplicity is intentional. Money disquantified org is meant to serve as a starting point, not a final authority.

Writing Style and Learning Experience

One reason money disquantified org resonates with readers is its conversational tone. Articles are written in plain English, making them easier to understand and apply. Explanations often connect financial ideas to everyday situations, which improves retention and comprehension.

Rather than presenting abstract definitions, the content focuses on practical meaning. Readers are shown how financial concepts affect daily life, which makes learning feel relevant and purposeful. This approach supports consistent learning and encourages readers to return regularly.

Money Disquantified Org Tools That Support Financial Awareness

Alongside written content, it provides simple financial tools that help users visualize their decisions. These tools are designed to support learning rather than replace professional planning. They allow readers to explore scenarios safely and understand outcomes without risk.

Readers are most likely to be faced with a short description of the purpose of the tools before using them. This context makes the users understand what the numbers entail and why they are important. Having touched the tools, the readers will be able to consider the outcome and change their financial mindset.

| Tool Type | Purpose |

| Budget Calculator | Helps users understand monthly spending patterns |

| Savings Planner | Assists with planning emergency funds |

| Investment Estimator | Shows how small contributions grow over time |

These tools reinforce lessons from articles and help transform knowledge into awareness. They are especially useful for visual learners who benefit from seeing financial concepts in action.

Strengths of Money Disquantified Org in Financial Education

Accessibility is the largest strength of Money Disquantified Org. The platform is not paid and the same is not necessarily based on prior financial knowledge. This eliminates one of the biggest obstacles that bar a significant number of individuals to learn about money.

One more strength is the attention to habits and mindset. The site stresses on consistency, patience, and discipline instead of encouraging shortcuts or dangerous tactics. This is an important message especially to the novices who require stability as opposed to pressure.

Some notable strengths include:

- Simple language without jargon

- Free access to all content

- Wide coverage of basic money topics

- Encouragement of healthy financial habits

Limitations Associated With Money Disquantified Org

Every educational finance platform has boundaries, and money disquantified org is no exception, especially when viewed from a long-term learning perspective.

1. Lack of Professional Financial Authority

It does not position itself as a licensed advisory platform, which implies that the content is informational, but not individual. The readers should learn that the information provided is there to create awareness, not to substitute the certified financial advice. This is significant in cases where big investments or taxes, as well as retirement planning, are concerned.

2. Limited Source Transparency

The site lays emphasis on simplified explanations though it does not necessarily give detailed sourcing or author credentials. This may complicate the situation of the advanced learners who may not independently verify information. Consequently, the readers are better served when they consider the information as a point of departure and not a point of termination.

3. Surface-Level Coverage for Advanced Topics

A number of financial issues are purposely made simple so that they are easy to read. Although it is beneficial to beginners, it can be repetitive or shallow to users who are experienced. It means that the platform emphasizes the comfort and clarity rather than depth itself, and this is what defines its learning experience.

Money Disquantified Org Compared With Larger Finance Platforms

Compared to established finance websites, money disquantified org prioritizes simplicity over authority. Larger platforms often provide detailed research but can feel intimidating to beginners. It fills the gap by offering a gentler entry point into financial learning.

Before exploring advanced platforms, many readers benefit from building a basic understanding here. This progression helps them approach complex resources with greater confidence and clarity.

| Platform | Best For | Content Depth |

| Money Disquantified Org | Beginners | Basic |

| Investopedia | Advanced learners | High |

| NerdWallet | Product comparisons | Medium |

This comparison highlights the role money disquantified org plays in the broader financial education ecosystem.

How Money Disquantified Org Fits Into a Learning Journey?

Using money disquantified org effectively requires realistic expectations. The platform is most effective as a good starting point to financial concepts rather than an overall solution. Before proceeding, the readers are able to acquire terminology, comprehend habits, and gain confidence.

Once the background is established, the readers can be more equipped to consult professionals or seek more advanced resources. This is a progressive method that eliminates confusion and helps in making informed decisions in the long run.

How to Use Effectively?

The most effective way to use money disquantified org is to treat it as a learning foundation. Readers can build understanding, improve habits, and gain confidence through the site. When they become comfortable, they would be able to proceed to more detailed resources with a better knowledge base. A moderate strategy is the best one. Acquire ideas here and check facts elsewhere and consult the professionals where needed. This will provide you with security and profitability in your investment life.

Conclusion

Money disquantified org is a place that offers a relaxed and friendly atmosphere to individuals who seek to learn about money without being stressed. It makes financial concepts easier, promotes healthy habits, and helps to learn slowly. The platform does not intend to take over the role of a professional, but it is significant in establishing a foundation of knowledge. As a first step on the right path towards becoming better financially aware, Money Disquantified Org can become a helpful tool in helping the beginner become more certain and clear on how to invest their money.

Also Read About: BetterThisWorld Money Approach for Practical Financial Stability